Hey there folks! Are you ready to tackle your tax responsibilities like a pro? We’ve got some fantastic news for you: the 2021 W9 Form is here, and we’re here to guide you through the process of filling it out online. No more hassle of printing out paper forms and digging through your filing cabinet. It’s time to go digital and make your life a whole lot easier!

Why Fill Out the 2021 W9 Form Online?

Let’s face it, nobody enjoys dealing with paperwork, especially when it comes to taxes. But fret not, because the world is becoming more and more digital by the day, and tax forms are no exception. With just a few clicks, you can now fill out the W9 Form for 2021 online, saving you time, effort, and the headache of managing physical documents.

Thanks to advancements in technology, you can now enjoy the convenience of filling out the W9 Form from the comfort of your own home or office. Simply visit our website, click on the provided link, and voila! You’ll be redirected to an easy-to-use online platform that guides you through each section of the form.

Thanks to advancements in technology, you can now enjoy the convenience of filling out the W9 Form from the comfort of your own home or office. Simply visit our website, click on the provided link, and voila! You’ll be redirected to an easy-to-use online platform that guides you through each section of the form.

Stay Organized with the Downloadable W9 Tax Form

Speaking of convenience, did you know that you can even download the W9 Tax Form for offline use? Sometimes, you might find yourself without an internet connection, but that shouldn’t stop you from staying on top of your tax obligations.

By simply downloading and printing the W9 form from the IRS website, you can keep a physical copy on hand whenever you need it. This ensures that you’re always prepared, regardless of whether you’re connected to the internet or not.

By simply downloading and printing the W9 form from the IRS website, you can keep a physical copy on hand whenever you need it. This ensures that you’re always prepared, regardless of whether you’re connected to the internet or not.

The IRS W9 Form 2021 Printable - Your Ultimate Solution

If you prefer the traditional pen-and-paper approach, don’t worry; we’ve got you covered too! The IRS provides a printable version of the W9 Form for 2021, which you can easily find and download from our website.

Grab your trusty pen, print out the form, and start filling it out at your own pace. This option is perfect if you enjoy the tactile experience of writing and find it easier to focus when you’re not staring at a screen. Just make sure your handwriting is legible, so there are no unnecessary hiccups in the processing of your tax information!

Grab your trusty pen, print out the form, and start filling it out at your own pace. This option is perfect if you enjoy the tactile experience of writing and find it easier to focus when you’re not staring at a screen. Just make sure your handwriting is legible, so there are no unnecessary hiccups in the processing of your tax information!

Decoding the W9 Form: What You Need to Know

Now that we’ve covered the different ways to access the W9 Form for 2021, let’s delve into its purpose and why it’s an essential piece of paperwork for freelancers, independent contractors, and businesses that work with them.

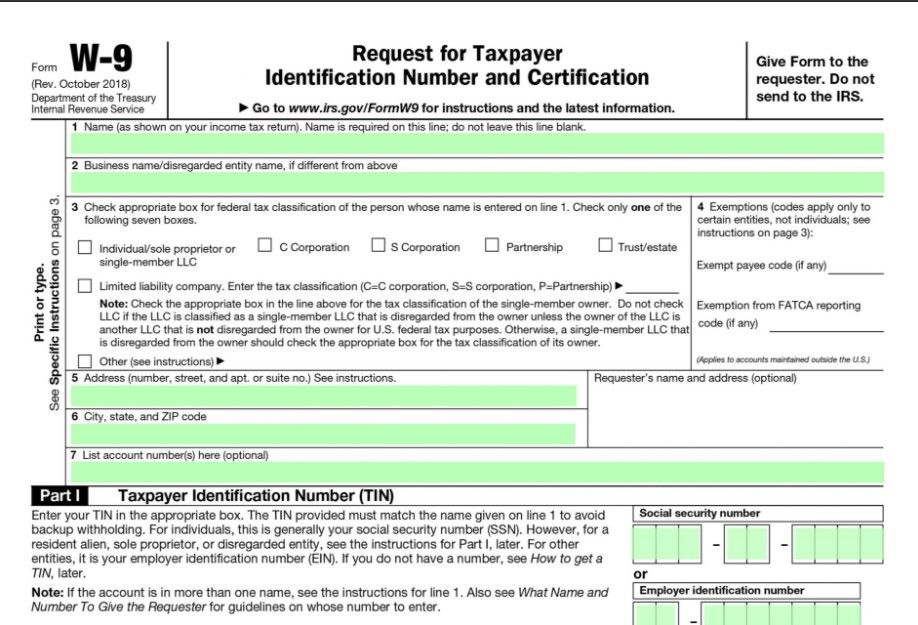

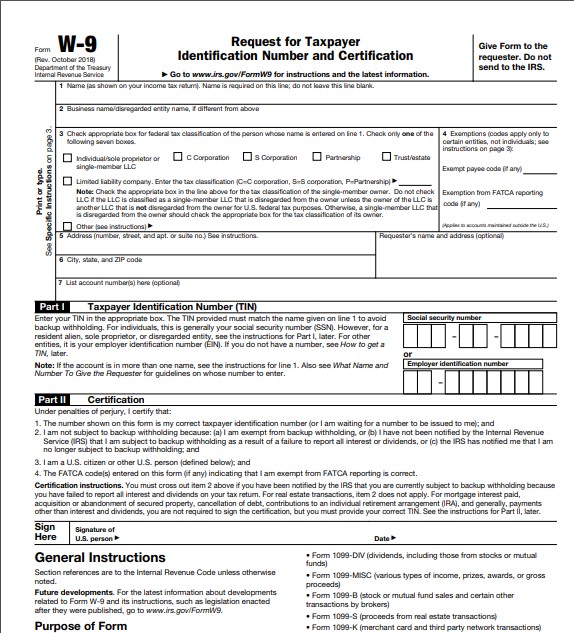

The main goal of the W9 Form is to collect important taxpayer information, such as name, address, and social security number (SSN) or employer identification number (EIN). This data helps businesses and clients to accurately report the income they pay to individuals or entities.

The main goal of the W9 Form is to collect important taxpayer information, such as name, address, and social security number (SSN) or employer identification number (EIN). This data helps businesses and clients to accurately report the income they pay to individuals or entities.

One key piece of information you’ll need to provide on the W9 Form is your tax classification. Are you a sole proprietor, an LLC, or a corporation? This will determine the type of information you’ll need to provide and how you’ll be taxed.

Remember, accurately filling out the W9 Form is crucial because it helps to ensure that you receive the necessary tax documents, such as the 1099-MISC form. Equally important, it helps businesses and clients comply with IRS regulations and avoid penalties or fines.

Final Thoughts

There you have it, folks! The 2021 W9 Form is at your fingertips, ready to be filled out. Whether you choose to go digital, utilize the downloadable version, or print it out, make sure you take the time to understand the form and provide accurate information.

No more procrastinating or dreading the tax season. With the W9 Form, you’re well on your way to maintaining proper documentation, satisfying the IRS requirements, and ensuring a smoother tax filing process.

Remember, tax obligations don’t have to be overwhelming. Take advantage of the resources available to you, such as the 2021 W9 Form, and make your tax journey a breeze!