When it comes to tax filing season, one of the most important forms that individuals need to complete is the W-2 form. This form is essential for both employees and employers as it provides crucial information about an employee’s wages and tax withholdings. In this post, we will take a closer look at the W-2 form and its significance.

Understanding the W-2 Form

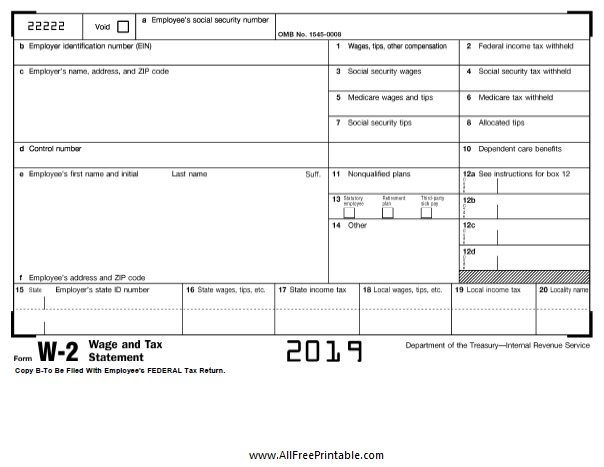

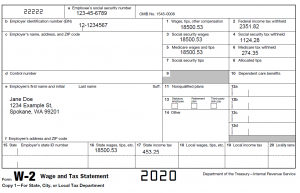

The W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the Internal Revenue Service (IRS). It contains important information about an employee’s earnings throughout the year, including wages, tips, and other compensation received from their employer.

The W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the Internal Revenue Service (IRS). It contains important information about an employee’s earnings throughout the year, including wages, tips, and other compensation received from their employer.

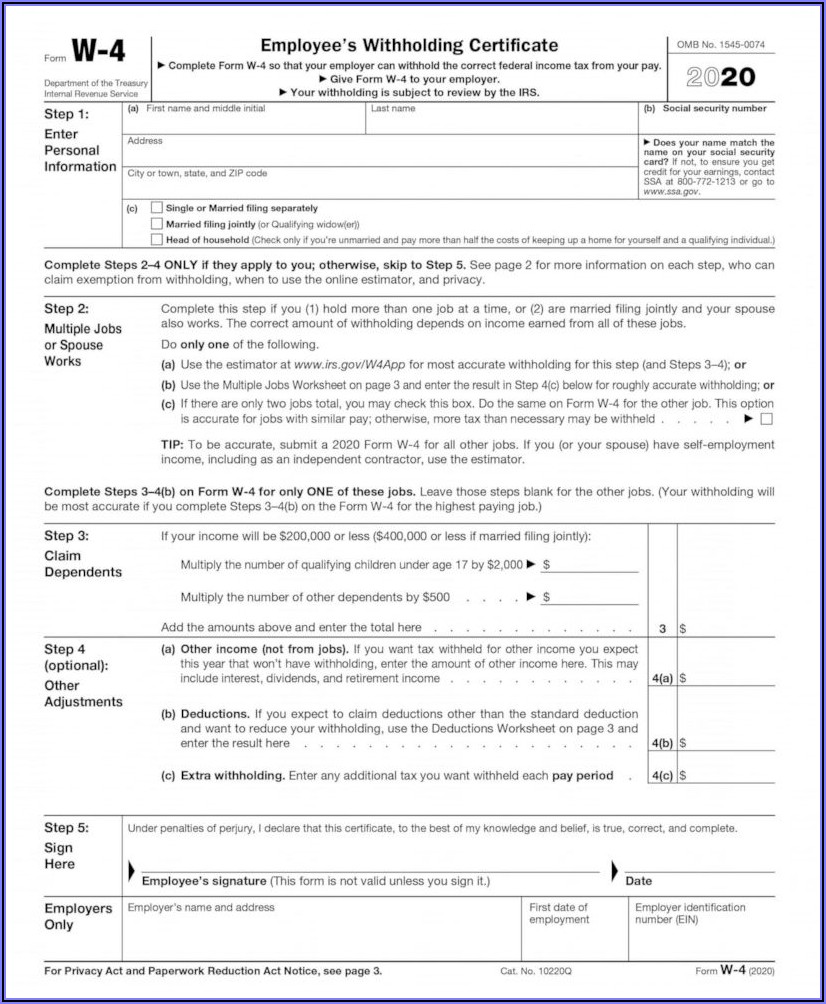

When it comes to understanding the W-2 form, it is crucial to pay attention to the various boxes and codes provided. Each box represents different types of information, such as wages, federal income tax withheld, Social Security and Medicare taxes, and more. These boxes help both the employee and the IRS calculate the correct amount of taxes owed.

When it comes to understanding the W-2 form, it is crucial to pay attention to the various boxes and codes provided. Each box represents different types of information, such as wages, federal income tax withheld, Social Security and Medicare taxes, and more. These boxes help both the employee and the IRS calculate the correct amount of taxes owed.

Importance for Employees

For employees, the W-2 form is essential for accurately filing their tax returns. It provides detailed information about their income and the taxes withheld by their employer. This information is necessary to determine the correct amount of taxes owed or if a tax refund is due.

For employees, the W-2 form is essential for accurately filing their tax returns. It provides detailed information about their income and the taxes withheld by their employer. This information is necessary to determine the correct amount of taxes owed or if a tax refund is due.

Additionally, the W-2 form includes important details such as the employer’s identification number, the employee’s social security number, and the employer’s contact information. These details ensure that the IRS can properly associate the income reported on the form with the correct taxpayer.

Significance for Employers

For employers, the W-2 form is crucial for fulfilling their tax obligations and ensuring compliance with the IRS. Employers must accurately complete and submit the W-2 form for each employee by the specified deadline, which is typically January 31st of each year.

For employers, the W-2 form is crucial for fulfilling their tax obligations and ensuring compliance with the IRS. Employers must accurately complete and submit the W-2 form for each employee by the specified deadline, which is typically January 31st of each year.

Tips for Completing the W-2 Form

Completing the W-2 form can be a complex task, especially for employers. Here are a few tips to ensure accuracy and compliance:

Completing the W-2 form can be a complex task, especially for employers. Here are a few tips to ensure accuracy and compliance:

- Double-check all information: Make sure all the details entered on the form are accurate, including the employer’s and employee’s identification numbers, as well as the wages and tax withholdings.

- Report all income: Include all compensation received by the employee, such as wages, tips, bonuses, and other taxable income. Failure to report all income could result in penalties for both the employer and the employee.

- Get professional help if needed: If you are unsure about completing the W-2 form correctly, it is advisable to seek professional assistance from a tax professional or an accounting firm.

Conclusion

The W-2 form plays a crucial role in the tax-filing process for both employees and employers. It provides valuable information about an employee’s earnings and tax withholdings, ensuring accurate tax calculations and compliance with IRS regulations. It is important for individuals to understand the significance of the W-2 form and ensure its accurate completion to avoid any issues with their tax returns.

The W-2 form plays a crucial role in the tax-filing process for both employees and employers. It provides valuable information about an employee’s earnings and tax withholdings, ensuring accurate tax calculations and compliance with IRS regulations. It is important for individuals to understand the significance of the W-2 form and ensure its accurate completion to avoid any issues with their tax returns.

Remember, always consult with a tax professional or refer to official IRS guidelines for specific instructions on completing the W-2 form.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal or financial advice.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal or financial advice.