The Form 1099-NEC is an essential document that individuals and businesses use to report nonemployee compensation to the Internal Revenue Service (IRS). It is crucial to understand the purpose and requirements of this form to ensure compliance with tax regulations.

What Is Form 1099-NEC?

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg) Form 1099-NEC, also known as Nonemployee Compensation, is used to report income earned by independent contractors, freelancers, and self-employed individuals who are not classified as employees. It is important to note that this form is separate from Form 1099-MISC, which previously included nonemployee compensation.

Form 1099-NEC, also known as Nonemployee Compensation, is used to report income earned by independent contractors, freelancers, and self-employed individuals who are not classified as employees. It is important to note that this form is separate from Form 1099-MISC, which previously included nonemployee compensation.

Instructions for Filling Out Form 1099-NEC

Filling out Form 1099-NEC requires accurate and detailed information. Here are a few key steps to complete this form:

- Identify the payer and recipient information, including names, addresses, and taxpayer identification numbers (TIN).

- Enter the total amount of nonemployee compensation paid during the tax year in Box 1.

- If applicable, report any federal income tax withheld in Box 4.

- Ensure that all information is accurately entered and double-check for any errors.

Why Is Form 1099-NEC Important?

Form 1099-NEC plays a crucial role in tax reporting and compliance. By accurately reporting nonemployee compensation, both businesses and independent contractors ensure that the IRS receives the necessary information to enforce tax laws. Failing to report or misreporting this income can result in penalties and legal consequences.

Form 1099-NEC plays a crucial role in tax reporting and compliance. By accurately reporting nonemployee compensation, both businesses and independent contractors ensure that the IRS receives the necessary information to enforce tax laws. Failing to report or misreporting this income can result in penalties and legal consequences.

IRS Form 1099-NEC Download and Online Filling

To download Form 1099-NEC, you can visit the official IRS website or trusted tax service providers. The form is available as a fillable PDF, allowing you to enter the required information electronically. Alternatively, you can choose to complete the form online through authorized platforms.

To download Form 1099-NEC, you can visit the official IRS website or trusted tax service providers. The form is available as a fillable PDF, allowing you to enter the required information electronically. Alternatively, you can choose to complete the form online through authorized platforms.

Form 1099-NEC Instructions and Tax Reporting Guide

Form 1099-NEC instructions provide detailed guidance on how to accurately complete and file the form. It is advisable to review these instructions carefully to ensure compliance. Additionally, there are comprehensive tax reporting guides available that provide valuable insights into reporting nonemployee compensation and other related tax obligations.

Form 1099-NEC instructions provide detailed guidance on how to accurately complete and file the form. It is advisable to review these instructions carefully to ensure compliance. Additionally, there are comprehensive tax reporting guides available that provide valuable insights into reporting nonemployee compensation and other related tax obligations.

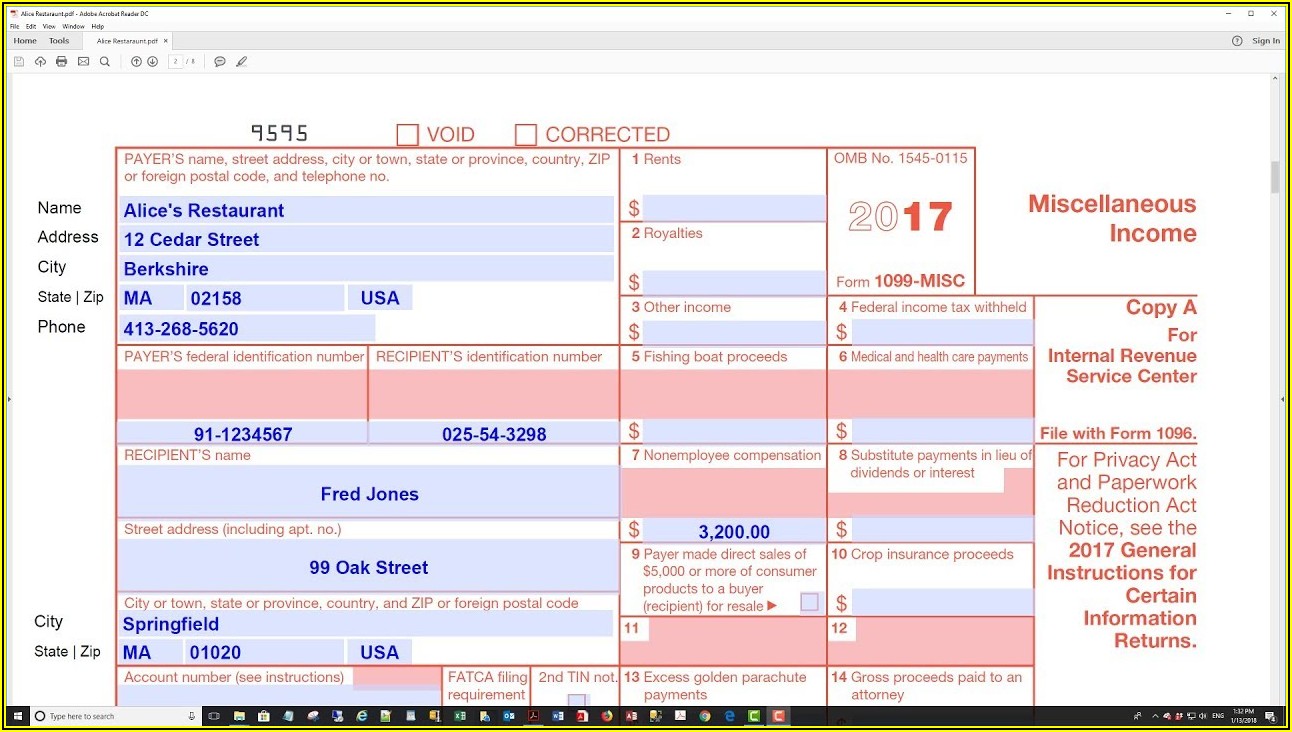

IRS Form 1099-MISC

While Form 1099-NEC specifically focuses on reporting nonemployee compensation, it is important to be aware of Form 1099-MISC as well. This form is still used to report various types of income, such as rents, royalties, and other miscellaneous income.

While Form 1099-NEC specifically focuses on reporting nonemployee compensation, it is important to be aware of Form 1099-MISC as well. This form is still used to report various types of income, such as rents, royalties, and other miscellaneous income.

Overall, Form 1099-NEC is an essential tool for accurately reporting nonemployee compensation. It ensures compliance with tax regulations and helps both businesses and independent contractors fulfill their tax obligations. By understanding the purpose and requirements of this form, individuals can navigate the complexities of tax reporting with confidence.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal or tax advice. For specific guidance on Form 1099-NEC and tax reporting, consult with a qualified tax professional or refer to official IRS resources.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal or tax advice. For specific guidance on Form 1099-NEC and tax reporting, consult with a qualified tax professional or refer to official IRS resources.