When it comes to tax documents, the W9 form is an essential piece of paperwork that you need to be familiar with. Whether you’re a freelancer, an independent contractor, or involved in any other type of business arrangement, understanding the purpose and importance of the W9 form is crucial. In this post, we will provide you with valuable information about the W9 form and even share some printable versions for your convenience.

What is a W9 Form?

A W9 form, also known as the Request for Taxpayer Identification Number and Certification form, is a document that the Internal Revenue Service (IRS) uses to collect information from individuals or entities that are classified as independent contractors or freelancers. This form is a way for the IRS to verify the taxpayer identification number (TIN) and gather other relevant details for tax reporting purposes.

It is essential to understand that the W9 form is not used for reporting income. Instead, it is used to gather necessary information to create the 1099-MISC form, which is used to report income paid to independent contractors or freelancers. By completing the W9 form, you are providing the necessary information for tax reporting purposes.

It is essential to understand that the W9 form is not used for reporting income. Instead, it is used to gather necessary information to create the 1099-MISC form, which is used to report income paid to independent contractors or freelancers. By completing the W9 form, you are providing the necessary information for tax reporting purposes.

Why is the W9 Form Important?

The W9 form is crucial for both the individual or entity providing their information and the party requesting it. For the individual or entity, it is necessary to ensure that their TIN and other personal details are accurately reported to the IRS. This helps prevent any discrepancies or issues when it comes to tax reporting and filing.

Additionally, businesses and organizations that hire independent contractors or freelancers also rely on the W9 form. The information provided on the form is used to prepare and issue the necessary tax documents, such as the 1099-MISC form. Having accurate and up-to-date information ensures that the reporting process is smooth and accurate.

Additionally, businesses and organizations that hire independent contractors or freelancers also rely on the W9 form. The information provided on the form is used to prepare and issue the necessary tax documents, such as the 1099-MISC form. Having accurate and up-to-date information ensures that the reporting process is smooth and accurate.

How to Fill Out a W9 Form

Now that you understand the importance of the W9 form, let’s go over the steps involved in filling it out. Remember, it’s essential to provide accurate information to avoid any issues come tax time. Here’s a step-by-step guide:

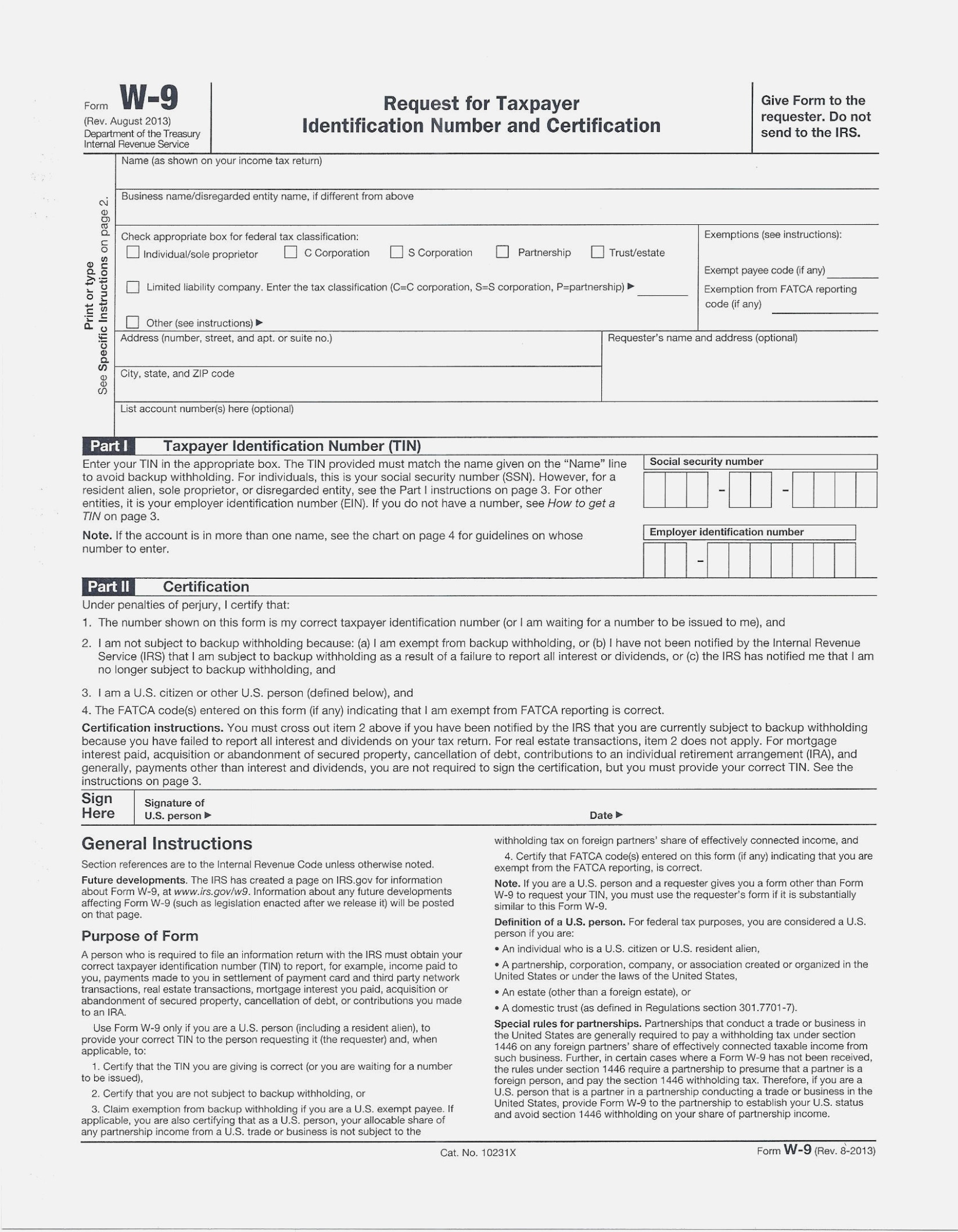

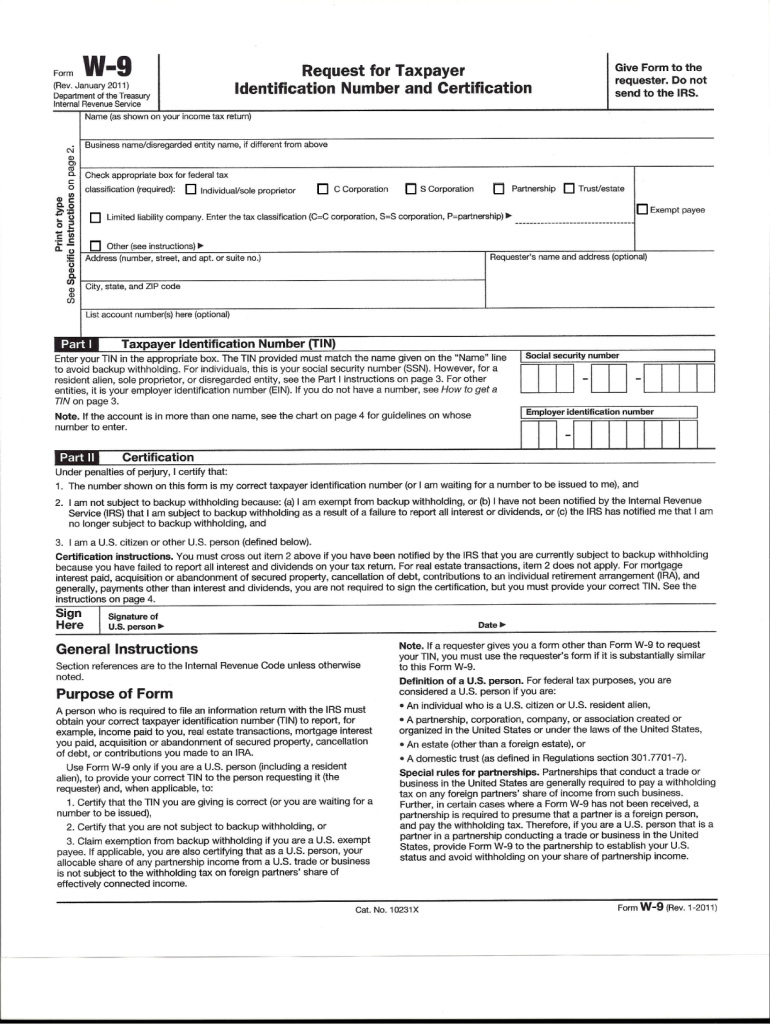

- Step 1: Download a printable W9 form from a reliable source. You can find free printable versions online, such as the one pictured below:

Ensure that the form you use is the most recent version. The IRS regularly updates the form, so it’s essential to stay up-to-date.

Ensure that the form you use is the most recent version. The IRS regularly updates the form, so it’s essential to stay up-to-date.

- Step 2: Provide your name and business name (if applicable) on the first line of the form.

- Step 3: Provide your business entity type, such as sole proprietorship, partnership, corporation, or LLC.

- Step 4: Enter your taxpayer identification number (TIN), which is usually your Social Security Number (SSN) or Employer Identification Number (EIN).

Make sure to double-check your TIN before submitting the form. An incorrect TIN can lead to an array of problems during tax filing.

Make sure to double-check your TIN before submitting the form. An incorrect TIN can lead to an array of problems during tax filing.

- Step 5: Indicate whether you have backup withholding or not. Backup withholding typically occurs when the IRS requires the payer to withhold a percentage of payment due to certain circumstances.

- Step 6: Sign and date the form to certify that the information provided is correct.

Once you have completed the form, you can submit it to the organization or individual that requested it. They will retain it for their records and use the information provided for tax reporting purposes.

Conclusion

Understanding the purpose of the W9 form and knowing how to correctly fill it out is essential for anyone involved in business arrangements as an independent contractor or freelancer. By providing accurate information on the form, you help ensure smooth tax reporting and avoid potential issues with the IRS.

Remember, always use the most recent version of the W9 form, which is available for free online. By following the step-by-step guide, you can confidently fill out the form and provide the necessary information to meet tax reporting requirements.